Banking Lies, Scandals & Secrets

Banking lies can erode trust overnight—and history shows that even the most prestigious financial institutions are not immune. Despite polished branding and public confidence, bank secrets often hide systemic misconduct, cover-ups, and manipulation. What begins as a profitable “strategy” can swiftly unravel into a full-blown banking scandal, shaking economies and destroying reputations.

From fake account openings to rigged interest rate benchmarks, this article uncovers five of the most shocking banking lies in modern financial history. These aren’t just isolated incidents—they represent a pattern of deception that thrived behind closed doors until exposed by regulatory crackdowns, independent audits, and courtroom revelations.

Each case serves as a reminder: when trust is traded for greed, the consequences can be global. Read on to see how these financial giants fell from grace—and how their secrets were finally brought to light.

Table of Contents

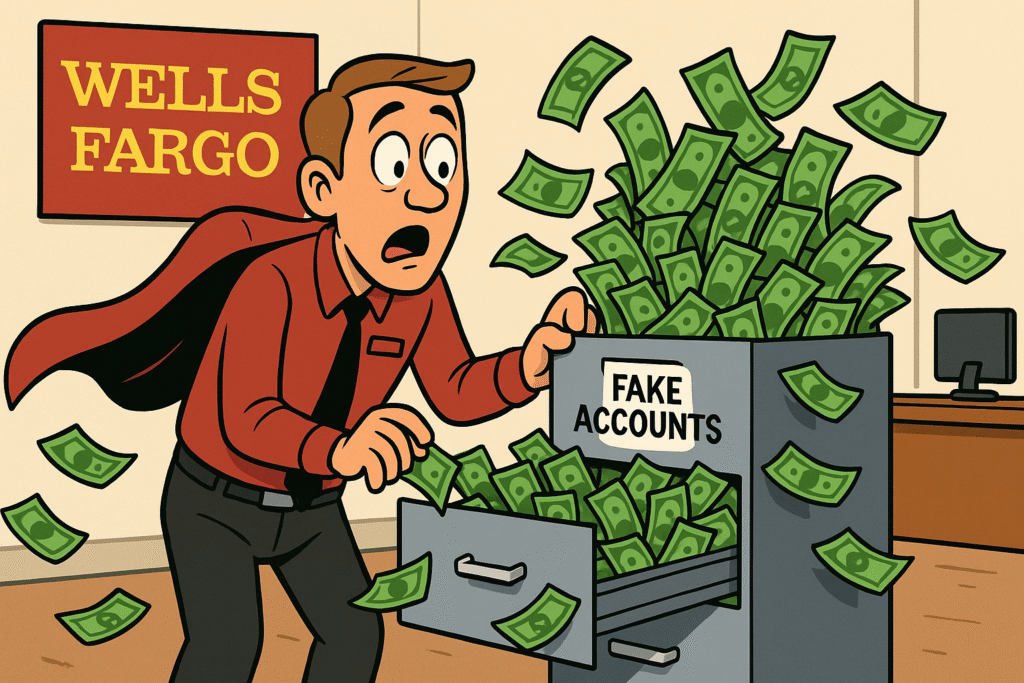

1.Wells Fargo – Fake Account Scandal

Among the most disturbing banking scandals in recent history, the Wells Fargo fake account debacle revealed how deeply embedded banking lies can be within even the most “trusted” institutions.

The Misleading Claim

“We never directed nor wanted our team members to provide products…that they didn’t want.”

—John Stumpf, former CEO of Wells Fargo, testimony before Congress (CBS News)

This carefully worded statement attempted to deflect blame—but regulators and whistleblowers would soon expose it as a banking lie, concealing one of the largest frauds in modern U.S. banking.

The Reality

From at least 2002 to 2016, Wells Fargo pressured employees with unrealistic sales quotas, rewarding those who hit targets and punishing those who didn’t. To survive, staff secretly opened approximately 3.5 million deposit and credit accounts without customer knowledge or consent—a stunning abuse of trust that remained a bank secret for years.

The Evidence

- DOJ Consent Order (2020): Detailed how employees “falsified records and misused customer identities” at scale.

- Bank Admission: Wells Fargo publicly conceded it had “collected millions of dollars in fees and interest to which [it] was not entitled.”

- OCC, SEC, and Federal Reserve reports: Confirmed widespread misconduct far beyond a few “rogue” actors.

The Consequences

- $3 Billion Settlement: In February 2020, the bank agreed to pay a massive settlement to resolve both criminal and civil investigations.

- Leadership Overhaul: CEO John Stumpf resigned under pressure, forfeiting millions. Several other executives followed.

- Lasting Damage: The banking scandal sparked class-action lawsuits, consumer outrage, and long-term regulatory oversight. The brand, once iconic, suffered years of reputational fallout.

This case remains a stark reminder of how banking lies and hidden agendas can spiral into institutional collapse. Once a bank secret is exposed, not even decades of built-up trust can shield a firm from the consequences.

2.Goldman Sachs – 1MDB Bribery Scheme

This global banking scandal revealed how one of Wall Street’s most powerful firms became entangled in a vast international corruption network—all while insisting on its innocence. Behind polished press statements and investor briefings, a massive bank secret was unfolding across borders.

The Misleading Claim

“We were lied to by foreign officials and had no knowledge of theft… the 1MDB bond offerings were meant to raise money to benefit Malaysia.”

—Goldman Sachs leadership, repeatedly denying responsibility (The Guardian)

Goldman Sachs attempted to downplay its role in the 1MDB affair, presenting itself as a victim. But mounting evidence exposed these denials as calculated banking lies—part of a broader effort to obscure internal wrongdoing.

The Reality

Between 2009 and 2013, senior Goldman bankers—most infamously Tim Leissner and Roger Ng—conspired to pay over $1 billion in bribes to high-ranking officials in Malaysia and the United Arab Emirates. The goal? Secure bond deals worth more than $6 billion through Malaysia’s sovereign wealth fund, 1MDB.

The operation bypassed Goldman’s internal controls, funneling illicit payments through a network of offshore shell companies. While billions vanished in corruption and embezzlement, Goldman collected roughly $600 million in fees, becoming complicit in what became one of the biggest bank secrets ever exposed.

The Evidence

- DOJ Deferred Prosecution Agreement: In October 2020, Goldman admitted it conspired to violate the Foreign Corrupt Practices Act (FCPA) and agreed to pay a historic $2.9 billion penalty.

- SEC Civil Complaint: Uncovered internal emails and documentation showing executives were aware of the bribery arrangements.

- International Investigations: Authorities in Malaysia, Switzerland, and Singapore corroborated U.S. findings, revealing a coordinated global effort to siphon billions from public funds.

The Consequences

- Criminal Pleas: Goldman’s subsidiaries in Hong Kong and Singapore pleaded guilty in U.S. federal court—the first criminal conviction of Goldman Sachs entities in its 150+ year history.

- Financial Penalties: The firm paid nearly $3 billion in total fines across U.S. and international jurisdictions.

- Leadership & Reforms: Though no top U.S. executives were charged, current CEO David Solomon implemented major compliance reforms to prevent future lapses.

- Reputational Fallout: Goldman faced investor lawsuits alleging deception over 1MDB-related risks—solidifying this case as one of the most reputationally damaging banking scandals of the century.

The 1MDB affair laid bare how far banking lies can go when profits are prioritized over ethics. What began as a discreet bank secret metastasized into a worldwide scandal involving embezzlement, bribery, and betrayal of public trust on a global scale.

3.Barclays – LIBOR Rate Rigging

The LIBOR rate rigging scandal marked a turning point in the public’s understanding of how deep-rooted and damaging banking lies can be. What started as a technical manipulation of interest rates exploded into a massive, global banking scandal—one that revealed a toxic culture of deceit within Barclays and beyond.

The Misleading Claim

“Only a small number of rogue traders were involved, and our culture remains sound.”

—Former CEO Bob Diamond and COO Jerry del Missier, in testimony before UK Parliament (Harvard Business Review)

Barclays also claimed it was simply reacting to “informal guidance” from institutions like the Bank of England. But the truth was far murkier. These assurances were banking lies, carefully crafted to deflect blame and preserve the bank’s image during a time of global financial panic.

The Reality

From 2005 to 2009, Barclays traders and senior managers manipulated the London Interbank Offered Rate (LIBOR)—a critical benchmark used to price trillions in loans, derivatives, and mortgages. The aim was twofold: to enhance the bank’s trading profits and to hide its real borrowing costs during the 2008 financial crisis.

This wasn’t just a few bad apples; it was a coordinated, sustained campaign of deception—an institutional bank secret that affected global markets.

The Evidence

- CFTC & FCA Enforcement Actions: The U.S. Commodity Futures Trading Commission and the U.K. Financial Conduct Authority found explicit chat logs and emails showing traders colluding with external parties (like hedge funds) to influence rate submissions.

- Internal Communications: Messages between Barclays traders spoke of rate manipulation as part of daily wins and losses, with some referring to it as “just part of the game.” These leaks proved management was aware and often complicit.

The Consequences

- $450 Million in Fines: In 2012, Barclays paid over $450 million to settle charges with U.S. and U.K. regulators. This included $160 million in criminal penalties and separate fines from the CFTC and FSA.

- Leadership Fallout: CEO Bob Diamond, COO Jerry del Missier, and other senior executives resigned under intense political and public pressure.

- Global Reform: The scandal led to sweeping reforms of the LIBOR system, eventually contributing to its planned phase-out and replacement with more reliable alternatives like SOFR and SONIA.

This scandal exposed how widespread banking lies could distort entire financial markets. What seemed like a harmless internal metric was, in reality, a fragile system vulnerable to exploitation—propped up by bank secrets and false assurances from top executives.

Barclays wasn’t the only institution involved, but it was the first to settle—triggering a domino effect across other global banks, regulators, and reform efforts that continue to shape financial markets today.

4.HSBC – Money Laundering and Sanctions Breaches

Few banking scandals have exposed such alarming failures of global oversight as HSBC’s involvement in money laundering and sanctions violations. Beneath the public image of the “world’s local bank” lay a deep bank secret: billions in dirty money flowing freely through its systems—enabled by neglected compliance, ignored warnings, and institutional inertia.

The Misleading Claim

“We have strong anti–money laundering controls and a deep commitment to sanctions compliance.”

—HSBC leadership, repeatedly asserting compliance strength even after evidence began to surface (The Guardian)

When confronted by lawmakers and the press, HSBC claimed any misconduct was historic, already “being corrected,” and often the result of former staff or external failings—classic banking lies aimed at preserving the bank’s reputation.

The Reality

Between 2006 and 2010, HSBC’s U.S. operations were grossly negligent in their anti–money laundering (AML) oversight. Investigations found the bank allowed over $881 million in proceeds from Mexican drug cartels to move through its accounts—unchecked and unflagged. At the same time, HSBC conducted hundreds of millions in transactions for sanctioned nations such as Iran, Libya, Sudan, and Burma—direct violations of U.S. law.

Despite repeated internal red flags, compliance teams were understaffed, underpowered, and often ignored, allowing these bank secrets to fester unchecked.

The Evidence

- 2012 U.S. Senate Permanent Subcommittee Report: Revealed “stunning oversight failures,” documenting how HSBC exposed the U.S. financial system to cartels, terrorists, and rogue states.

- DOJ Deferred Prosecution Agreement: HSBC admitted to willfully facilitating money laundering and breaching sanctions, agreeing to pay a record fine.

- Internal Warnings Ignored: Memos from compliance heads described HSBC’s risk process as “rubber-stamping” decisions. Despite credible alerts, top executives failed to act decisively—prioritizing profit over principle.

The Consequences

- $1.9 Billion Penalty: In 2012, HSBC paid the largest-ever fine under the U.S. Bank Secrecy Act to resolve criminal charges.

- Five-Year DOJ Monitoring: HSBC entered a strict oversight agreement, monitored by the U.S. Department of Justice and the Federal Reserve to overhaul its AML and compliance programs.

- Leadership Overhaul: Senior compliance personnel were replaced, and then-CEO Stuart Gulliver issued a public apology before U.S. Congress.

- Reputational Collapse: Once seen as a model of global reach, HSBC’s brand was tainted by this banking scandal, sparking regulatory backlash and new calls for structural banking reform.

This case remains a textbook example of how banking lies—disguised as corporate diplomacy—can hide lethal systemic risks. The HSBC affair revealed just how dangerous a bank secret can become when compliance is treated as a cost, not a core duty.

5.Danske Bank – Estonian Branch Money Laundering

This was not just a banking scandal — it was one of the largest money laundering operations in European history. Danske Bank’s Estonian branch processed hundreds of billions of euros in suspicious transactions, while top executives publicly claimed their compliance systems were sound. Behind closed doors, a bank secret of staggering scale was unfolding, shaking the financial world.

The Misleading Claim

“Our Estonian branch meets all compliance obligations and maintains U.S. dollar clearing only because it adheres to the highest standards.”

—Danske Bank’s official stance in early regulatory filings (DOJ)

But in civil complaints and whistleblower disclosures, Danske was accused of “lying to U.S. banks” about its internal controls and deliberately obscuring its high-risk customer base. These banking lies weren’t just misleading—they were a central part of a long-running fraud.

The Reality

Between 2007 and 2015, Danske Bank’s Estonian branch facilitated the movement of at least €200–230 billion in suspicious transactions—with some estimates reaching as high as €800 billion. Much of the money originated from Russia, Azerbaijan, and other high-risk regions, routed through offshore shell companies to obscure its source.

An internal whistleblower warned as early as 2013 that local staff were “complicit in money laundering schemes”, but his reports were ignored or suppressed. This was a textbook case of a bank secret protected by silence, inaction, and a flawed culture of compliance.

The Evidence

- Internal Danske Report (2018): A leaked audit exposed “long-lasting systemic failures” in AML controls, revealing that compliance officers repeatedly failed to report red-flag transactions.

- DOJ Deferred Prosecution Agreement: In December 2022, Danske pleaded guilty to conspiracy to defraud U.S. banks by hiding the true nature of its Estonian operations.

- Whistleblower Reports & Regulatory Files: The case relied heavily on insider testimony, internal audits, and findings by Danish and European regulators.

The Consequences

- CEO Resignation: Then-CEO Thomas Borgen resigned in 2018 as public and regulatory scrutiny intensified.

- Shareholder Fallout: Danske Bank’s stock price plummeted by 50% amid revelations and investigations.

- Over $2 Billion in Penalties: The bank agreed to forfeit more than $2 billion to U.S. authorities, one of the largest ever penalties for AML failings.

- Compliance Overhaul: Danske pledged a full-scale revamp of its compliance framework and remains under tight regulatory scrutiny in both Europe and the U.S.

This scandal revealed how banking lies can deceive not only regulators but also global correspondent banks, allowing dirty money to infiltrate the world’s financial arteries. What happened at Danske Estonia is a stark reminder of what happens when bank secrets are buried beneath profits and spin—and how catastrophic the fallout can be when the truth finally emerges.

Conclusion: The True Cost of Banking Lies

From fake accounts at Wells Fargo to secret bribery schemes at Goldman Sachs, and from rigged interest rates to massive money-laundering pipelines, these cases expose a troubling pattern: behind polished PR statements and reassurances of integrity, banking lies often fester. In each case, what began as a bank secret—denied, downplayed, or deliberately hidden—eventually grew into a full-scale banking scandal with global consequences.

Public trust in financial institutions is not just a matter of branding—it’s the foundation of market stability. Yet as these scandals show, when banks substitute truthful reporting with misleading narratives, the cost is borne not just by shareholders and executives, but by everyday customers, economies, and democratic institutions.

The aftermath—multi-billion dollar fines, leadership purges, investor lawsuits, and lasting reputational damage—only came after the damage was done. In nearly every case, the warning signs were there: internal red flags, whistleblower reports, or risk alerts that were ignored or silenced.

What these scandals make abundantly clear is this: transparency and accountability are non-negotiable in modern banking. When oversight fails and deception thrives, the fallout is never limited to a single institution. The ripple effects of cover-ups and compliance failures threaten the integrity of the entire financial system.

In a world where trust can vanish overnight, it’s not just about catching lies after the fact. It’s about preventing banking lies from taking root at all.

FAQs on Banking Lies, Scandals & Secrets

What are some common examples of banking lies?

Banking lies often include misleading claims about account practices, compliance, or financial reporting. For example, fake account openings, rigged interest rates, and hidden bribery schemes are all banking lies that have triggered major scandals in recent years.

How do banking scandals usually come to light?

Banking scandals typically emerge through regulatory investigations, whistleblower disclosures, independent audits, or court rulings that uncover hidden practices or bank secrets. These revelations expose the truth behind misleading public statements.

Why do banks keep certain information secret?

Banks may maintain bank secrets to protect competitive advantage or reputation, but sometimes these secrets hide unethical or illegal practices. When these concealed actions—such as money laundering or fraud—are revealed, they cause significant damage to trust and market stability.

What consequences do banks face after a scandal involving banking lies?

Banks implicated in scandals often face hefty fines, leadership changes, regulatory sanctions, and loss of customer confidence. Additionally, long-term reforms and enhanced oversight typically follow to prevent repeat offenses.

How can customers protect themselves from the effects of banking lies?

Customers should stay informed about their banks’ reputations, review account statements carefully, and report suspicious activities. Awareness of banking scandals and transparency efforts can empower consumers to make safer financial choices.

What role do regulators play in uncovering bank secrets and scandals?

Regulators investigate suspected banking lies and enforce laws designed to promote transparency and compliance. They audit financial institutions, impose penalties, and require corrective measures to uphold the integrity of the financial system.

Sources – Banking Lies

Wells Fargo – Fake Account Scandal

- U.S. Department of Justice Consent Order – Wells Fargo

- CBS News – CEO John Stumpf Testimony

- SEC Press Release – Wells Fargo Fraud

- OCC News Release – Enforcement Actions

Goldman Sachs – 1MDB Bribery Scheme

- DOJ – Goldman Sachs 1MDB Settlement

- The Guardian – Goldman Sachs Denials & Fines

- SEC Complaint – 1MDB Bribery Scheme

- Goldman Sachs – Media Relations Archive

Barclays – LIBOR Rate Rigging

- CFTC – Order Against Barclays for LIBOR Manipulation

- FCA Final Notice – Barclays LIBOR Case

- The Washington Post – LIBOR Scandal Overview

- Harvard Business School – Barclays LIBOR Case Study

HSBC – Money Laundering & Sanctions Breaches

- DOJ – HSBC Deferred Prosecution Agreement

- U.S. Senate – HSBC Money Laundering Report (2012)

- The Guardian – HSBC Scandal Coverage

- BBC News – HSBC CEO Apology